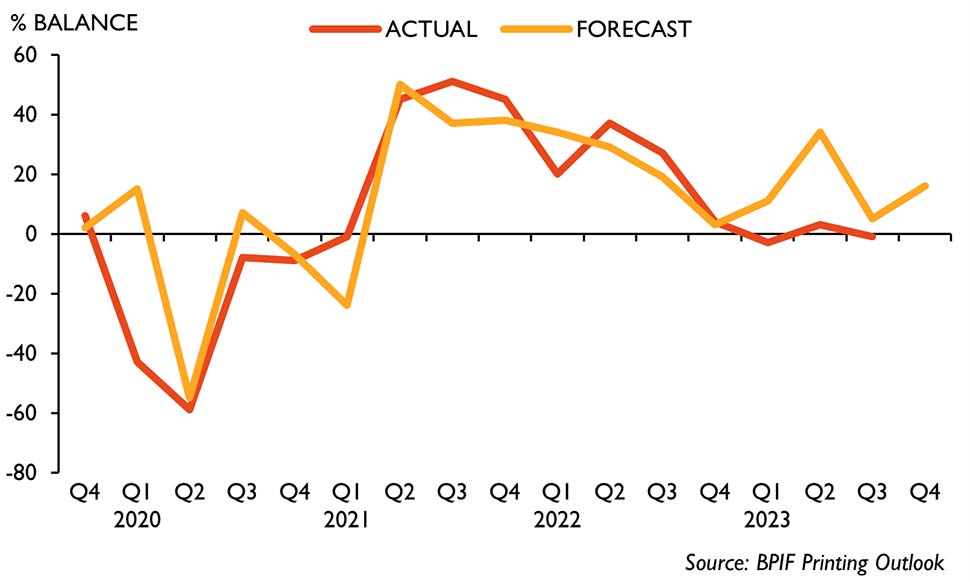

The UK’s printing and printed packaging industry struggled with its performance in Q3, at least as far as output and orders are concerned; however, expectations are more positive for Q4.

The forecast for Q3 was for some output growth to return; that expectation has turned-out to be overly optimistic as more companies experienced a decline in output than an increase. As mentioned last quarter, a fragile economy, lingering concerns over inflation levels, for both consumers and businesses, and the possibility of further interest rate increases; have not made it easier to do business. Printers continue to concentrate on controlling costs, increasing productivity, and looking for new sales opportunities. Some cost pressures have eased, and are expected to ease further, but so too have prices – and lower prices yet may be required to encourage more output and order growth in Q4.

The latest Printing Outlook survey reveals that one-third (33%) of printers managed to increase their output levels in the third quarter of 2023, whilst another third was able to hold output steady. That left 34% experiencing a decline in their output levels. The resulting balance (the difference between the ups and the downs) was therefore -1, below the +5 that was forecast, and a little worse from the +3 experienced in Q2. The Q3 results extends the flatlining period in output growth to four quarters.

VOLUME OF OUTPUT - SUBDUED IN Q3, MORE HOPE FOR IMPROVEMENT IN Q4

The output balance of -1 was below the forecast of +5 for Q3. A balance of +16 is forecast for Q4.

The output balance of -1 was below the forecast of +5 for Q3. A balance of +16 is forecast for Q4.

Forecasts for Q4 are for an improvement in output growth, though it may be more of a case of fewer companies experiencing declining growth rather than a significant seasonal boost. Output growth is forecast to increase for 36% of companies, 44% predict that they will be able to hold output levels steady in Q4. That leaves 20% expecting output levels to fall. The resulting balance forecast is +16 for the volume of output in Q4. This Q4 forecast is welcome yet underwhelming for a period that under ‘normal’ circumstances would be expected to experience a stronger seasonal boost. Whilst an under-performing economy, with cost-control a paramount concern and increasing pressure to accelerate digitisation in some client markets, presents challenges to some sectors, there are still growth areas within print. Further falls in inflation and a lowering of interest rate expectations will do much to improve business confidence and performance expectations.

Concern over sales levels has become the new top business concern for printing companies. Rising from third ranking last quarter, concern over the level of sales replaces competitor pricing as the most selected business concern. Competitor pricing still attracted significant attention, it was selected by 53% of respondents, down from 56% previously – it is just that concern over sales levels has surged from 41% to 57%. Companies are having to adapt and work differently, or harder, to maintain and grow sales in markets, and with clients, that are also changing rapidly.

TOP BUSINESS CONCERNS - % OF RESPONDENTS SELECTING

Wage pressures, now the third ranked concern, was selected by 52% of respondents, up from 35%, and a ranking of 4 last quarter. Most companies conducted their pay reviews earlier in the year; however, concerns do remain over wage pressures and the effect of the next round of minimum wage increases, and more importantly the knock-on effect that has on wage structures and pay differentials throughout businesses. Continued stubborn inflation, and the effect that has on pay review demands, means wage pressure concerns will likely become more prominent early in 2024.

The BPIF Printing Outlook Q4 2023 report features sections on industry turnover, business concerns, capacity, costs, pay reviews, paper and board, and much more.

Kyle Jardine, BPIF Economist, said:

“As part of our continued commitment to driving sustainability improvement in the industry, we once again added a sustainability research section to the survey – building on the initial introduction six months ago.

“Over half of respondents now tell us that they are measuring their carbon emissions – many more than reported doing so back in April. I would strongly encourage BPIF members to download the full report, set aside a few minutes to check out the contents, and consider responding to the next survey in January. This research really does make a difference to how we can represent our industry.”

Charles Jarrold, BPIF Chief Executive, said:

“It has been a challenging year so far, but it is pleasing to see an uplift in confidence and expectations for the final quarter, even if it’s not quite in line with what might be considered a normal seasonal boost.

“The survey newly reports on uncertainty levels, thankfully they are now expected to stabilise and, with more than three-fifths of the industry with an excellent, or good, cash flow position, there is well-founded hope for the period ahead. A period in which many companies will be looking to exert further control on their costs and explore what diversification options they are well-place to take advantage of.”

Wayne Kershaw, National Sales Manager, Digital Solutions ProPrint Management & Sales, Canon UK & Ireland, and sponsors of the Printing Outlook report, said:

“It’s been an amazing year, despite familiar challenges in the sector and we’re thrilled to be in Q4. As always, we wish to commend the BPIF for the brilliant work undertaken in delivering key statistics, data and trends to drive our ever-changing print industry.”

Summary of key findings:

- The UK’s printing and printed packaging industry struggled with its performance in Q3, at least as far as output and orders are concerned; however, expectations are more positive for Q4.

- Forecasts for Q4 are for an improvement in output growth, though it may be more of a case of fewer companies experiencing declining growth rather than a significant seasonal boost.

- Unlike orders and output, the view of the general state of trade did improve in Q3 – ahead of the expectations previously formed for that period.

- Concern over sales levels has become the new top business concern for printing companies.

- Industry capacity utilisation has improved slightly in October, in comparison to July – but remains below what might normally be expected for the time of year.

- More companies decreased, than increased, employment levels in Q3. Finding and securing adequate labour has been a frequently voiced concern this year, but recruitment expectations are up slightly for Q4.

- Average price levels decreased, on balance, in Q3, though a small majority did manage to hold prices steady.

- Labour costs have become the primary cost concern, whilst other cost levels remain high – cost pressure has continued to ease for some of the other main cost components.

- The smallest possibly majority of printers have been able to hold margins steady, but margins have been squeezed further, on balance, as downward pressures on prices continues to offset any benefits derived from cost reductions.

- When it comes to company plans to increase profitability in the next twelve months, cost control remains the primary area of focus.

- Less than one-fifth (19%) of respondents reported that they had conducted a pay review in Q3, the resulting average (mean) change in basic pay was 4.6%.

- Export orders exceeded 5% of turnover for 11% of respondents in October, down from 14% in July, and the lowest figure for three years. For these companies export orders continued to perform poorly in Q3 – though the reality was not as bad as expected.

- The accelerated importance of sustainability issues, accountability and enhancing sustainability credentials is continuing in in the printing and printed packaging industry.

- In October, over 56% of respondents reported that they are measuring their carbon emissions, up from 38% in April.

- Almost four-fifths of respondents (79%) are working to reduce their carbon footprint, and over one-third (35%) of these have set emission reduction targets – up from 29% six months ago.

- The post popular area of attention for sustainability related investments was waste reduction (as it was six months ago), selected by 76% of respondents.

- Almost three-fifths of respondents (57%) have noticed an increase in demand for sustainable products in the last 12 months.

- UK consumption of printing papers and boards fell to its lowest volume on record in Q2.

- The last quarter had continued to see a gentle reduction in wholesale electricity and natural gas prices, until the last few weeks when significant volatility and price rises have been observed.

Featured in Printing Outlook this quarter:

- Output and orders – last quarter and forecast for this quarter.

- Business confidence, concerns, and uncertainty levels.

- Turnover – annual and monthly turnover analysis and forecasts.

- Capacity – utilisation and constraints.

- Costs – paper & board, ink, labour, energy and average cost structure.

- Trend data on employment, prices, costs, margins, profits, cash flow and productivity.

- Profitability benchmarks and plans for improvement.

- Pay Reviews – activity and average % changes.

- International trade – export orders and price trends.

- Sustainability – carbon emissions, Net Zero, investment focus, and more.

- Consumables – paper consumption and printing ink data.

- Energy – sector update and comment.