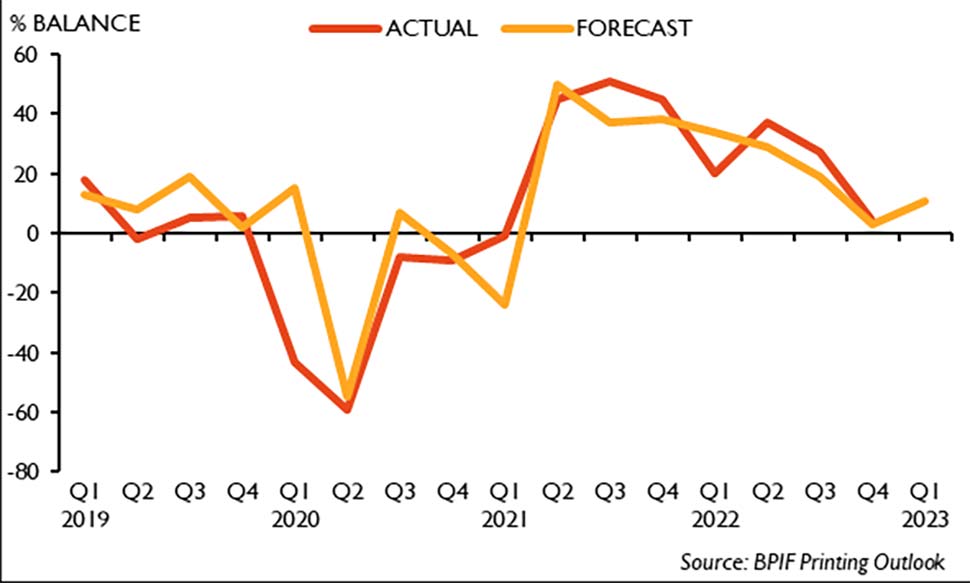

Growth in output and orders was only marginally positive in Q4 as the reality for performance in the UK printing and printed packaging industry turned out almost exactly as the forecasts provided in the previous quarter.

The expectation for Q1 is for a slight performance improvement to be realised. Despite the heightened economic and political uncertainty, the extreme energy cost shocks, and a continuation of price inflation amongst all cost areas – many firms in the industry have at least been able to find some stability in their own performance. However, there was still a significant minority of companies that have not been able to prevent a contraction in their business in Q4.

The latest Printing Outlook survey reveals that one-third (33%) of printers managed to increase their output levels in the final quarter of 2022, a further 38% were able to hold output steady. However, the remaining 29% did experience a decline in their output levels.

The resulting balance (the difference between the ups and the downs) was +4, well below the +27 in Q3, but just above the Q4 forecast (+3). A seventh consecutive quarter of positive output growth is very welcome but is of course becoming harder to maintain as we move beyond the sharp Covid-enforced decline in 2020, and the extended recovery period from that.

VOLUME OF OUTPUT - Q4 GROWTH FELL IN-LINE WITH FORECAST

The output balance of +4 was just above the forecast of +3 for Q4. A balance of +11 is forecast for Q1.

A slightly more positive output balance is expected in Q1. Output growth is forecast to increase for 35% of companies, 41% predict that they will be able to hold output levels steady in Q1. That leaves 24% expecting output levels to fall. The resulting balance forecast is +11 for the volume of output in Q1. This Q1 forecast has been formulated amongst an expectation that cost inflation may have peaked but is limited by uncertainty surrounding continued Government support to help with energy costs.

Confidence, in Q4, continued to fall in-line with expectations – and has now, for the first time in two years, returned a negative balance. Confidence is now expected to remain at a depressed level in Q1 this year. As previously identified, lingering and extreme cost pressures, combined with a resurgence in economic uncertainty and political instability, has clearly eroded earlier recoveries in confidence.

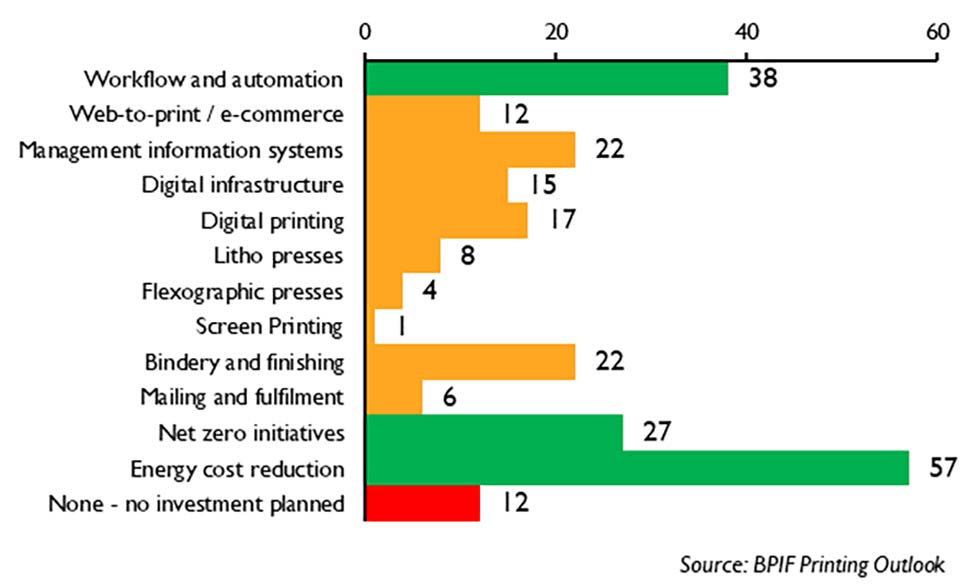

With concerns over confidence, traditional investment targets seem to be attracting a cautious approach according to current investment intentions for 2023. However, some areas are receiving a significantly increased investment focus. Investment in plant and machinery, and buildings, may well be subdued this year as companies take a cautious approach to expenditure in those areas. Product and process innovation investment is also looking likely to be restrained. However, training and retraining, and net zero and energy efficiency initiatives are attracting significantly increased investment.

Companies were asked to select their top three investment targets for the next 12 months. A few areas stand out – energy cost reduction is the clear front runner. Workflow and automation, and net zero initiatives follow behind, ahead of bindery and finishing, and management information systems.

Energy cost reduction was identified as a top three investment target by 57% of respondents, 38% selected workflow and automation, and 27% net zero initiatives. 22% of companies reported that management information systems would be a top-three priority, as did 22% for bindery and finishing. 12% of respondents recorded that they did not intend to make any investments in 2023.

TOP INVESTMENT TARGETS - % OF RESPONDENTS SELECTING

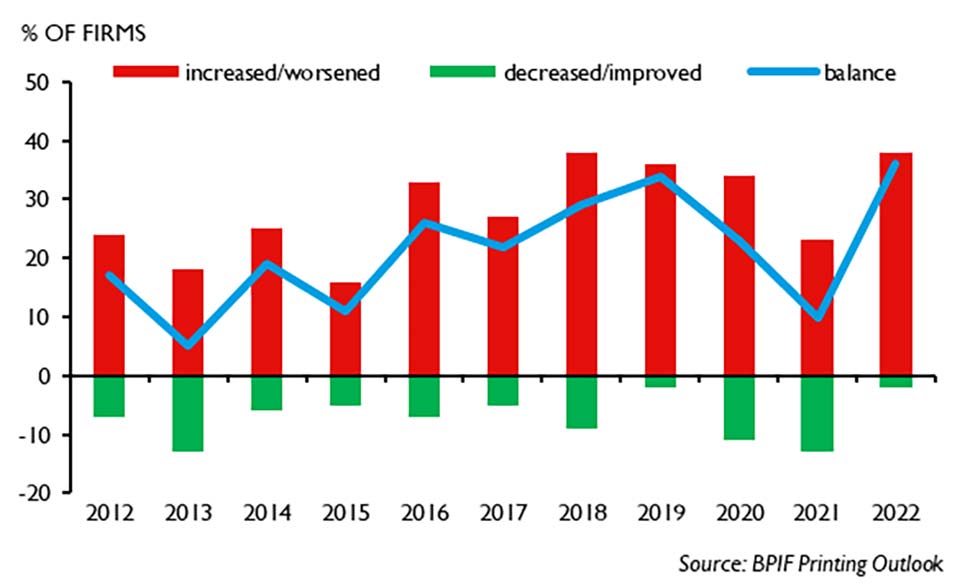

The most noticeable recent changes around access to finance and credit conditions have been an increase in the cost of finance, and an increase in levels of late payment and bad debt. Late payment in the printing industry is a long-standing concern that tends to periodically spike; and that’s exactly what appears to be currently happening. The balance of change in the incidence of late payments in 2022 (the blue line in the chart) has increased from 2020, to a level not seen in the last 11 years. 38% of respondents reported an increase in the incidence of late payments by customers in the past 12 months (up from 23% in 2021), 2% reported an improvement. The incidence of late payment chart attempts to show how the resulting balance (+36 in 2022) is derived from the increases and decreases since this question was introduced to the survey in 2012. The latest balance is not only deep in the red zone, but also the highest on record.

INCIDENCE OF LATE PAYMENT BY CUSTOMERS

The BPIF Printing Outlook Q1 2023 report also features sections industry turnover, business concerns, capacity, costs, pay reviews, paper and board – and much more. Included for the first time is some global insight from Messe Duesseldorf and their latest drupa Global Trends Report.

Kyle Jardine, BPIF Economist, said:

“The UK printing industry is continuing to recover but it is not finding it easy to maintain this recovery. The wider economic landscape has dented industry confidence; and growing industry turnover statistics mask the challenges in a way that paper, board, and ink consumption statistics do not.

“Companies are adapting, and many are still looking to grow. The full report shows that investment budgets and priorities for many companies have been re-evaluated in the wake of the current cost crisis – difficulties in recruiting labour have focused investment towards automation and workflow efficiencies; and high energy costs have made net zero and energy efficiencies a much more popular target.”

Summary of key findings:

- Growth in output and orders was only marginally positive in Q4 as the reality for performance in the UK printing and printed packaging industry turned out almost exactly as the forecasts provided in the previous quarter. The expectation for Q1 is for a slight performance improvement to be realised.

- Confidence, in Q4, continued to fall in-line with expectations – and has now, for the first time in two years, returned a negative balance. Confidence is now expected to remain at a depressed level in Q1 this year.

- Energy costs remain the top business concern for printing companies, they have now been the number one concern for the last year.

- Turnover forecast estimates for December and January have been downgraded, but some growth is still expected to return in February and March this year.

- Industry capacity utilisation in January was noticeably lower than in October, though there was a higher proportion operating at between 80% and 89% capacity.

- Recruitment challenges continue to thwart employment intentions, but there has still been a net positive balance of companies increasing their employment levels in Q4.

- Average price levels continued to increase for most companies in Q4, though that is no longer expected to be the case in Q1.

- Extensive and persistent cost pressure remains a dominant feature affecting companies in the printing and printed packing industry, however there is now an expectation that this pressure is going to ease in 2023.

- Paper, board, and other substrate costs is the largest cost component with a 36% share, on average, of total costs.

- More printers have been able to hold margins steady but, on balance, cost inflation has still outweighed output price inflation to put margins under more pressure in Q4.

- Over one-third (34%) of respondents reported that they had conducted a pay review in Q4, the resulting average (mean) change in basic pay was 5.2%.

- Traditional investment targets seem to be attracting a cautious approach according to current investment intentions for 2023, however some areas are attracting a significantly increased investment focus.

- The most noticeable recent changes around access to finance and credit conditions have been an increase in the cost of finance, and an increase in levels of late payment and bad debt.

- It turned out to be a disappointing Q3 as far as UK consumption of printing papers and boards is concerned. Consumption in Q3 2022 was considerably lower than in Q2 2022, and significantly lower than Q3 2021.

- Printing ink sales fell sharply in Q3 2022 pushing annualised sales down to a level last seen at the height of the pandemic fallout in late 2020 and early 2021.

- The last quarter has seen a very significant – and welcome - easing of wholesale electricity and natural gas prices, as mild weather and demand reductions have reduced the pressure on energy supplies for the winter.

Featured in Printing Outlook this quarter:

- Output and orders – last quarter and forecast for this quarter.

- Turnover – annual and monthly turnover analysis and forecasts.

- Business confidence and concerns.

- Capacity – utilisation and constraints.

- Costs – paper & board, ink, labour, energy and average cost structure.

- Trend data on employment, prices, costs, and margins.

- Profits, cash flow and productivity.

- Pay Reviews – activity and average % changes.

- International trade – export orders and price trends.

- Investment – key targets.

- Financing and credit conditions – access to finance, late payment, and payment terms

- Industry insolvency and financial health statistics.

- Consumables – paper consumption and printing ink data.

- Energy – sector update and comment.

- Global printing outlook – drupa Global Trends.

For further information on Printing Outlook go to www.britishprint.com/printingoutlook

For any queries on this release please contact kyle.jardine@bpif.org.uk