The first quarter of 2023 has turned out to be significantly more challenging than expected for the UK’s printing and printed packaging industry.

Output and orders both suffered declines in Q1 as high costs, higher prices, and subdued demand all combined to restrain production.

However, the outlook for Q2 is much more positive. A climate of stubbornly high inflation, amidst a cost of living, and cost of business crisis has dampened demand for portions of the industry. An expected easing of cost pressures in the current quarter underlies the revived expectations for orders and output in Q2.

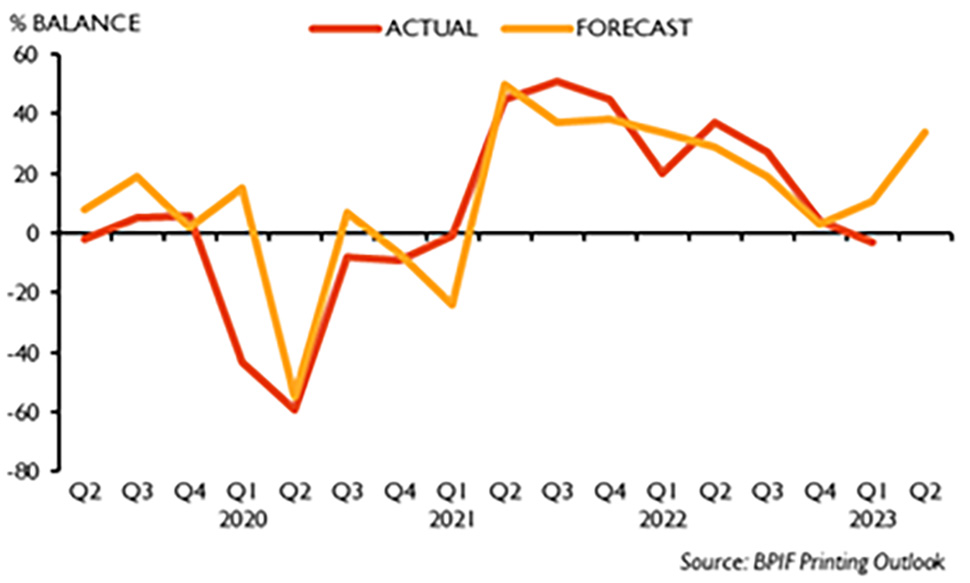

The latest Printing Outlook survey reveals that one-third (33%) of printers managed to increase their output levels in the first quarter of 2023, a further 29% were able to hold output steady. However, the remaining 38% experienced a decline in their output levels. The resulting balance (the difference between the ups and the downs) was -5, below the +4 in Q4, and well below the Q1 forecast (+11). This decline in output ends the seven consecutive quarter of positive output growth that the industry has experienced as part of the recovery from the impacts of Covid and comes just as it looks as though cost increases are balancing out.

VOLUME OF OUTPUT - Q1 SEES FIRST CONTRACTION FOR TWO YEARS

The output balance of -3 was below the forecast of +11 for Q1. A balance of +34 is forecast for Q2.

The output balance of -3 was below the forecast of +11 for Q1. A balance of +34 is forecast for Q2.

A significantly more positive output balance is expected in Q2. Output growth is forecast to increase for 43% of companies, 48% predict that they will be able to hold output levels steady in Q2. That leaves 9% expecting output levels to fall. The resulting balance forecast is +34 for the volume of output in Q2. This Q2 forecast follows an unexpectedly obstinate and high level of inflation, formed amidst delayed evidence of an end to dramatic cost increases in some, but not yet all, areas.

Unlike orders and output, confidence in Q1 continued to closely track expectations – and remained negative. However, confidence is also now expected to be boosted throughout Q2. As previously identified, lingering and extreme cost pressures, combined with economic uncertainty and political instability, had eroded earlier recoveries in confidence. But now, despite the current challenges, companies are forming a more positive mindset on the short-term outlook for the industry.

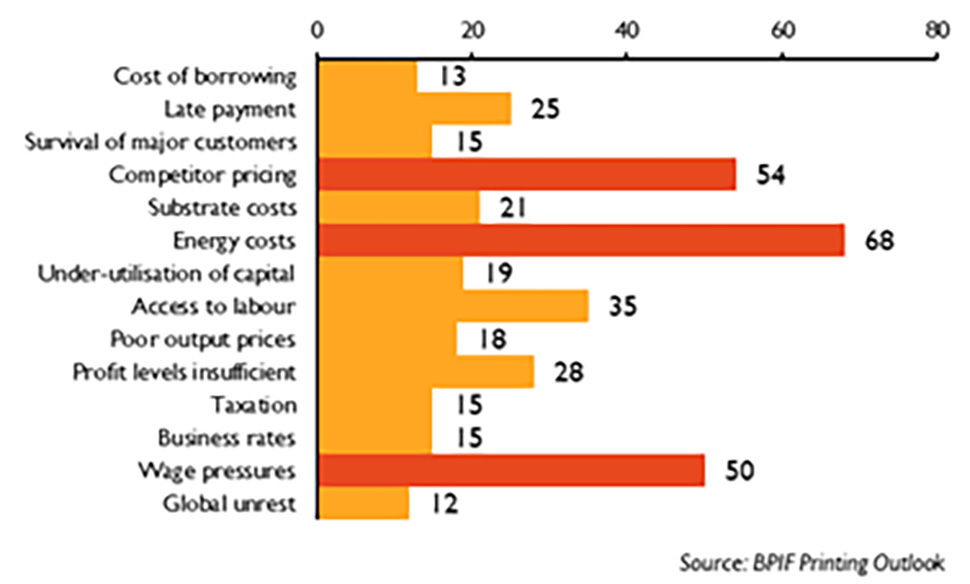

Energy costs remain the top business concern for printing companies, they have been the number one concern since April last year. Energy costs were selected by 68% of respondents, down from 75% in January, and 83% in October. Competitor pricing levels – or rather the perception that some competitors are pricing below cost – was the second highest ranking concern, selected by 54% or respondents in April, the same proportion as in January.

The third ranking concern is now wage pressures, selected by 50% or companies. This is down from 51% in January but has entered the top three ranked concerns primarily due to a significant drop-off in the proportion of companies selecting substrate costs (paper, board, plastics etc.) as one of their top business concerns. Substrate costs has now fallen outside the top five ranking of concerns for the first time since January 2021. Concern over wage pressures has been heightened by recent minimum wage increases, and the knock-on effect that has on wage structures and pay differentials throughout businesses. Continued high levels of inflation, and the effect that has on pay review demands, has also added to wage pressure concerns.

TOP BUSINESS CONCERNS - % OF RESPONDENTS SELECTING

The BPIF Printing Outlook Q2 2023 report features sections on industry turnover, business concerns, capacity, costs, pay reviews, paper and board, and much more – including, this quarter, a new section on sustainability.

Kyle Jardine, BPIF Economist, said:

“Sustainability credentials are becoming more important in the printing and printed packaging industry. For the first time the Printing Outlook survey has included a section of questions related to sustainability, the intention is to attempt to understand a bit more about what actions companies are taking towards making sustainability improvements. Almost two-fifths (38%) of respondents have reported that they are measuring their carbon emissions. The full report has more information on what emissions are being measured, the tools being used, and identifies the most popular sustainability-related investment targets.

Charles Jarrold, BPIF Chief Executive, said:

“Lingering and extreme cost pressures, combined with economic uncertainty and political instability, had eroded earlier recoveries in confidence. But now, despite the current challenges, companies are forming a more positive mindset on the short-term outlook for the industry.

“Prospects for later in the year still depend upon the UK navigating a smooth path through a period of continued high energy costs, stubborn inflation, and economic instability. Whilst there is no shortage of pressures for companies to deal with – inflation is still expected to fall sharply as we progress further through 2023, and energy costs are expected to settle further.”

Carlotta Basile, Production Portfolio Marketing Manager, Canon UK & Ireland, and sponsors of the Printing Outlook report, said:

“We’re privileged to continue our partnership with the BPIF through our sponsorship of its Printing Outlook report – delivering the latest trends to the print industry each quarter.

“2023 has already been an exciting year so far with a number of products launched across our portfolio. The latest report has itself been printed on one of our new V-series devices, the Canon imagePRESS V1350, the flagship device in our colour digital cut sheet range. Offering exceptional performance, and the highest productivity, it reaches a speed of 135ppm on a wide range of media up to 500 gsm delivering flawless and precise results. We’re excited to announce that the new imagePRESS V1350 is now in our Customer Experience Centre in Birmingham and we’re welcoming customers to book in for a demonstration to see the benefits of this device for themselves.

“We’d like to thank the BPIF and its members for this opportunity and hope that we can further build on our work together throughout 2023.”

Summary of key findings:

- The first quarter of 2023 has turned out to be significantly more challenging than expected for the UK’s printing and printed packaging industry. Output and orders both suffered declines in Q1 as high costs, higher prices, and subdued demand all combined to restrain production. However, the outlook for Q2 is much more positive.

- Unlike orders and output, confidence in Q1 continued to closely track expectations – and remained negative. However, confidence is also now expected to be boosted throughout Q2.

- Energy costs remain the top business concern for printing companies, they have been the number one concern since April last year.

- Unfortunately, there has since been a drop-off in the reported monthly turnover data. December, January, and February in particular, all reported disappointingly low levels of turnover. Data for March is expected to be better and, whilst April may be subdued, growth is forecast to be a little stronger in May and June.

- Industry capacity utilisation has continued to fall - in April capacity was noticeably lower than in January, although there was a slightly higher proportion operating at more than 70% capacity.

- A challenging start to the year has meant more companies reduced employment than increased employment in Q1.

- Average price levels increased, on balance, in Q1, though as predicted most companies managed to hold prices steady.

- Extensive and persistent cost pressure has been a dominant feature affecting companies in the printing and printed packing industry for the last two years. However, except for labour costs, there is now an expectation that this pressure will ease throughout 2023.

- A greater proportion of printers have been able to hold margins steady but, on balance, cost inflation has continued to outweigh output price inflation to put margins under more pressure.

- Almost half (46%) of respondents reported that they had conducted a pay review in Q1, the resulting average (mean) change in basic pay was 4.7%.

- Sustainability credentials are becoming more important in the printing and printed packaging industry. Almost two-fifths (38%) of respondents have reported that they are measuring their carbon emissions.

- UK consumption of printing papers and boards did recover in Q4 last year, from a very poor performance in Q3, but remained below the level from Q4 2021.

- The last three months delivered further welcome reductions in UK wholesale electricity and natural gas prices, as high gas storage levels and benign temperatures continued to ease pressure on energy supply.

Featured in Printing Outlook this quarter:

- Output and orders – last quarter and forecast for this quarter.

- Business confidence and concerns.

- Turnover – annual and monthly turnover analysis and forecasts.

- Capacity – utilisation and constraints.

- Costs – paper & board, ink, labour, energy and average cost structure.

- Trend data on employment, prices, costs, margins, profits, cash flow and productivity.

- Pay Reviews – activity and average % changes.

- International trade – export orders and price trends.

- Sustainability – attention levels companies are devoting to this.

- Industry insolvency and financial health statistics.

- Consumables – paper consumption and printing ink data.

- Energy – sector update and comment.