Worth a total of $743.4 billion in 2020, the global print industry will see this as a liminal year that will redefine its future across the 2020s.

The coronavirus crisis will act to accelerate trends already evident in the market – a diminishing importance of publications and graphics work pushing print businesses towards packaging print, and the implementation of smarter, more digitised, short-run printing.

Post-Covid scenario projections in the new Smithers report – The Future of Print to 2030 – shows total output in 2020 will be 41.4 trillion A4 print equivalents; down 13.4% on 2019. This has seen global value drop from $814.7 billion to $743.4 billion. Publication, advertising and graphic applications have been worst affected; while packaging & label print is proving more resilient.

A revival of normal business activity in 2021 will see the market rebound slightly to reach $752.8 billion; but much of the volume lost in 2020 will not return. Value growth will return to push the market to $846 billion in 2030, as it undergoes a profound redefinition.

This will be reflected in print substrates, total volume will fall from 1.95 trillion square metres in 2019, to 1.85 trillion square metres forecast in 2030. Overall tonnage will increase from 251.7 million tonnes to 264.4 million tonnes over the same period, as heavier basis weight packaging grades are employed and graphic paper volumes decline.

For print service providers (PSPs) the economic shock of the pandemic will lead to a significant fall in the number of sites in operation with bankruptcies, acquisitions and mergers. Smithers’ analysis shows that those companies that do survive will have to adjust to a new marketplace to remain competitive. This will place a new premium on cost, responsiveness and digitisation.

PSPs are looking to broaden the range of products and services they provide. In 2020 this has included providing social distancing signage and personal protective equipment (PPE). This trend will expand, with more PSPs moving into industrial and functional decoration.

To safeguard against future shortages and supply chain disruption, buyers will favour agility and faster time-to-market for many products. Improvements in response will take place as print companies adjust to the “Amazon-Effect” and expectations of same-day or next-day delivery, making rush jobs the new normal. In labels and packaging some brands will take production in-house, or invite partners to cooperate via through-the-wall operations.

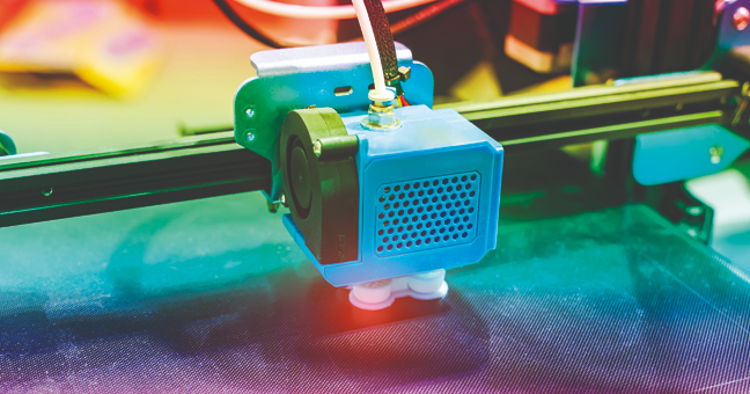

This will create further impetus to incorporate more digital and Industry 4.0 concepts in the print room and beyond; using workflow and automation to simplify artwork generation and print production, while embracing online specification and ordering. There will be interest in new techniques, such as serial manufacturing, and support for the wider use of digital – particularly inkjet – presses.

In ordering, by 2030, print jobs will contain process information; allowing commissions to be assigned to providers automatically, based on time/cost/location or any other criteria. This will benefit larger digitally integrated print suppliers.

Automation on analogue and digital print lines is already accelerating. By 2030, multiple manual production and administration tasks will handled by robots, with vision systems controlling quality. Machine learning will be built in, to allow machines to take more decisions about print or finishing quality. Artificial intelligence will be more prevalent in print from creation to delivery. In administration it can minimise waste and environmental impact, as these become new parameters for buyers.

This will lead ultimately to the evolution of the hyper-autonomous press. By the end of the decade new equipment builds will be highly autonomous with operator involvement reduced to specific problem-solving actions.

The impact of Covid-19 in 2020 is assessed authoritatively in the new Smithers study The Future of Print to 2030. This is combined with analysis of the emergent technology and business trends that will shape the next decade for printing. This insight is quantified in definitive market data and forecasts for 2015-2030, segmented by all key parameters (print process, substrate, end-use application, geographic market) in over 170 tables and figures.

This essential market strategy guide is available to purchase now priced $6,500 (€5,250, £4,750). Orders placed before 31 December 2020 will receive a 10% discount.