Compared to the third quarter of 2008, Group sales decreased 8.1 percent to 681 million Euro, which indicates that the crisis-driven decline in Agfa-Gevaert's markets is bottoming-out.

The Group's recurring gross profit margin improved from 30.1 percent in the third quarter of 2008 to 32.3 percent. It was positively influenced by efficiency programs, lower raw material prices and certain one-off effects and negatively impacted by manufacturing inefficiencies due to lower use of capacity.

Continuing its strict cost management, Agfa-Gevaert further reduced its Selling and General Administration expenses. The average monthly SG&A expense was brought down from 51 million Euro in the third quarter of 2008, to 44 million Euro in the third quarter of 2009, which is a cost decrease by 13.7 percent. The SG&A expenses represented 19.4 percent of sales, versus 20.8 percent in the third quarter of 2008.

The Group's recurring EBITDA (the sum of Graphics, HealthCare, Specialty Products and the unallocated portion) increased from 54 million Euro in the third quarter of 2008 to 68 million Euro. Recurring EBIT increased strongly from 27 million Euro to 43 million Euro.

The restructuring and non-recurring items resulted in an expense of 7 million Euro, versus 8 million Euro in the third quarter of 2008.

As in the first half of 2009, the non-operating result was affected by pension provisions (mainly concerning inactives), to cover for increased pension deficits in theUSAand theUK. The non-operating result amounted to minus 23 million Euro.

Taxes amounted to 8 million Euro, the same as in the third quarter of 2008.

The net result amounted to 4 million Euro, compared to minus 13 million Euro in the third quarter of 2008.

Balance sheet and cash flow

* At the end of September 2009, total assets were 2,931 million Euro, compared to 3,160 million Euro at the end of 2008.

* Inventories were 514 million Euro (or 97 days). Trade receivables (including deferred revenue and advanced payments) amounted to 532 million Euro, or 70 days and trade payables were 190 million Euro, or 36 days.

* Notwithstanding the limited impact of the securitization program, net financial debt improved to 500 million Euro at the end of September 2009, compared to 569 million Euro at the end of June 2009. Net financial debt improved by 350 million Euro over the past 2 years.

* Net operating cash flow amounted to 55 million Euro.

Agfa Graphics' sales decreased 8.8 percent versus last year's third quarter. Both the market environment and the activity levels were in line with the second quarter, but sales were positively influenced by certain one-off effects.

Profitability was positively impacted by efficiency programs, by lower raw material prices and by the above mentioned one-off effects. Negative effects came from the underutilization of the manufacturing capacity, bad debt provisions and competitive pressure. Compared to the third quarter of 2008, Agfa Graphics further reduced its Sales and General Administration expense with 9 million Euro.

The recurringEBITDA margin amounted to 8.8 percent of sales. The recurring EBIT margin increased to 5.6 percent of sales.

In prepress, Agfa Graphics received its first order for :N92v printing plates from the Chinese Guangzhou Daily, one of the world's top 100 daily newspapers. Furthermore, Agfa Graphics supplied an :Avalon N8 platesetter to Sungwon Adpia, the largest consumer of Computer-to-Plate printing plates in the Korean Printing industry.

In Norway, Agfa Graphics signed an important contract with Hjemmet Mortensen Trykkeri AS, the largest printer in the country. The deal includes the installation of two :Avalon N16 platesetters, a service contract as well as a three-year contract for :Energy Elite printing plates. Agfa Graphics also signed an exclusive 5-year printing plate contract with Roularta Media Group, a majorBelgian-French publishing and printing firm.

Also in prepress, Agfa Graphics announced the signing of an agreement with Kemtek Imaging Systems Ltd. for the distribution, service and support of Agfa Graphics' product range for commercial printers in Southern Africa.

In industrial inkjet, Agfa Graphics' next generation range of :Anapurna large-format printers continued the success of the last quarters. With contracts signed all over the world, Agfa Graphics was able to expand its market position in the large-format segment.

Furthermore, Agfa Graphics introduced new features for its :Dotrix Modular inkjet press. The new Express Print Mode increases the press' productivity by 35 percent. The second feature expands the :Dotrix Modular's color gamut.

In the USA, Digital Packaging Solutions recently installed Agfa Graphics' :Dotrix Modular press. The system enables the company to deliver on-demand services for the packaging industry.

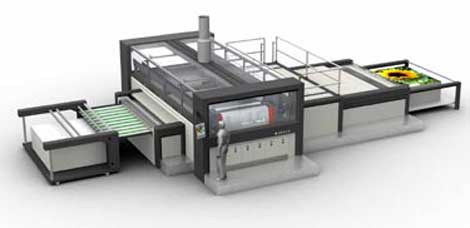

The world's first :M-Press Tiger was successfully installed at the SMP Group in London. The :M-Press Tiger is the second generation of the :M-Press industrial flatbed press. In recent months, various orders were booked for Agfa Graphics' high-end inkjet press.

Outlook - For the rest of the year, the Agfa-Gevaert Group does not expect major changes in the market environment.